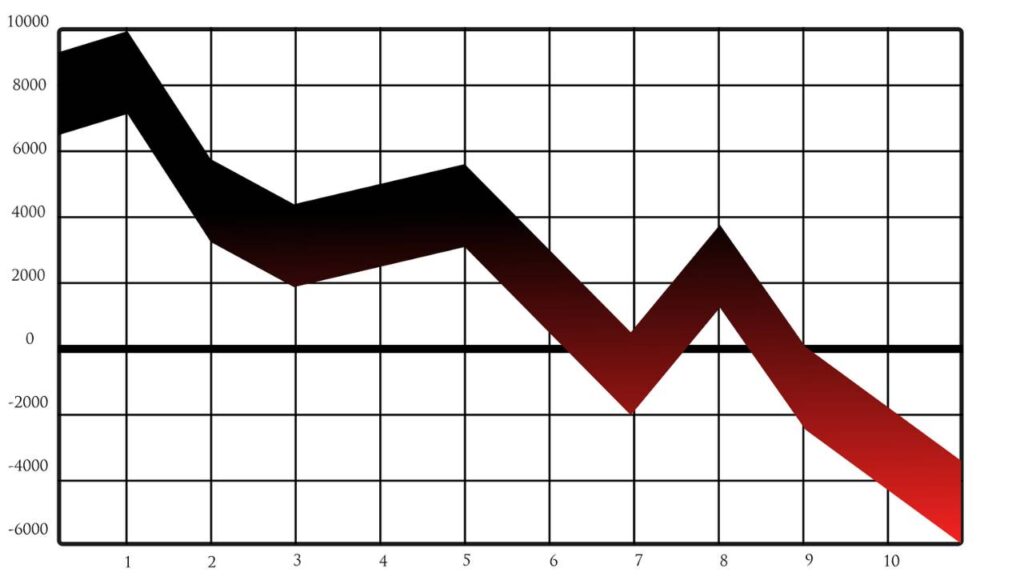

Running a business requires constant vigilance over finances. The question of whether your business is losing money is critical and can determine future success or failure. If you’re finding that profits are consistently falling short of your targets, it might be time to examine your financial practices and strategies.

For small businesses, financial missteps can be particularly damaging. Rising costs, misaligned pricing strategies, or unexpected expenses could be eroding your profits without you even realising it. Regular audits and assessments of your financial health are essential to identify where your business might be bleeding money.

Taking action now can prevent potential losses in the future. Aligning expenses with revenue, effectively managing cash flow, and ensuring sound financial planning are key. By being proactive, you protect your small business and secure its longevity in an often unpredictable market.

Understanding Financial Health

To ensure the success of your business, comprehending your financial health is crucial. Financial health refers to your company’s ability to manage financial obligations, generate profit, and sustain operations over time.

Evaluating your financial health involves analysing various indicators. Key metrics include profit margins, cash flow, and debt levels. These provide insight into profitability and liquidity.

- Profit margins represent how much of your sales translate into profit. Higher margins indicate a more profitable business. To improve margins, consider streamlining operations to reduce costs.

- Cash flow is the movement of money in and out of your business. Positive cash flow is essential for covering expenses and investing in growth. Monitoring cash flow allows you to manage shortages and plan for future investments.

- Debt levels must be manageable. Excessive debt can strain resources and hamper growth. Maintaining a reasonable debt-to-equity ratio ensures a balanced financial structure.

- Regular financial audits help in identifying issues early. Staying informed about your financial status enables you to make strategic decisions effectively. Consider seeking professional advice if needed.

- Record keeping is vital. Keeping accurate and up-to-date records aids in tracking performance and ensures compliance with regulations. Investing in reliable accounting software can streamline this process.

Focus on these aspects to maintain and improve the financial health of your business. Staying vigilant allows your business to thrive amidst market challenges.

Common Areas of Revenue Loss

A common source of revenue loss in businesses is ineffective inventory management. When your stock levels are not properly monitored, you may either end up overstocking or understocking. Overstocking ties up valuable cash, which could have been used elsewhere, whereas understocking can lead to lost sales opportunities and dissatisfied customers.

Another area to watch is pricing strategy. Incorrect pricing can directly impact your profit margins. Pricing too high may deter potential customers while pricing too low might not cover your costs adequately. Regularly reviewing your pricing strategy can help strike the right balance.

Employee productivity is also crucial. Inefficiencies and lack of engagement among staff can lead to lower output and increased costs. Investing in training and employee engagement initiatives can motivate your team and enhance productivity, reducing unnecessary expenses.

Focus on controlling operational costs, as high administrative and operational expenses can eat into your profits. Evaluate your expenses regularly to identify any areas where cost reductions can be implemented without jeopardising quality or service.

Watch your sales and marketing efforts as well. Ineffective marketing campaigns that do not reach your target audience are particularly harmful to SME owners interested in selling. Focusing on targeted marketing strategies and analysing their effectiveness can improve return on investment.

Additionally, poor customer retention is a significant factor. Acquiring new customers is more expensive than retaining existing ones. Implementing loyalty programmes and ensuring excellent customer service can help maintain a steady revenue stream.

Inefficient Processes

Inefficient processes in your business can lead to significant financial losses. Redundant tasks, outdated methods, and lack of automation are common culprits. These inefficiencies can cause delays and increased costs.

Consider your workflow. Are there repetitive tasks that could be automated? Automation can increase efficiency, reduce errors, and save time. Evaluate your current tools and technology to ensure they meet the demands of your business effectively.

Another area to examine is communication. Poor communication channels can lead to misunderstandings and rework. Encourage clear and direct communication amongst your team to minimise these errors.

Regularly review and update your processes. Keeping them streamlined can help optimise productivity. Identify bottlenecks through process mapping, and involve team members to provide insights for improvement.

Training is essential. Ensure your staff are equipped with the necessary skills and knowledge. Continuous training can enhance their efficiency and proficiency, reducing overall process inefficiencies.

Focus on quality management as well. Inconsistent quality can lead to waste and dissatisfaction. Implementing quality control measures can help maintain standards and improve customer satisfaction, leading to better financial outcomes.

Mismanaged Inventory

Mismanaged inventory can severely impact your business’s financial health. When you don’t have the right items, in the right quantities, at the right time, it leads to lost sales and surplus costs. Poor tracking systems increase the risk of having too much or too little stock, which can disrupt cash flow.

Consider the implications of excess inventory. Items that sit unsold tie up capital and storage space, potentially leading to waste if they spoil or become obsolete. On the other hand, insufficient stock levels can result in missed opportunities and dissatisfied customers.

By investing in reliable inventory management software, you can maintain an optimal balance. These systems help you monitor stock levels, forecast demand and streamline reordering processes. Conducting regular audits of your inventory can also help identify discrepancies and areas for improvement.

Training your staff to manage inventory effectively is another essential step. Ensure they understand the importance of accurate stock tracking and how to use available tools efficiently. This can prevent common errors that contribute to inventory mismanagement.

Ultimately, getting a strong grip on your inventory processes reduces the likelihood of financial loss and enhances customer satisfaction. Concentrating on better inventory practices positions your business for long-term success.

Energy Loss

Energy loss is a significant factor that can silently drain your business’s profits. It often stems from inefficient energy use in heating, lighting, or equipment operation. Simple practices overlooked regularly can inflate your energy bills.

Addressing these inefficiencies begins with identifying key problem areas. In some cases, insulation may be inadequate, allowing valuable heat to escape and cold air to enter. You might consider making use of thermal imaging for affordable energy loss detection. This technology can pinpoint areas where energy is wasted, enabling targeted action.

Routine maintenance of systems such as HVAC can prevent unnecessary energy consumption. Efficient lighting solutions, including LED lights, can further reduce energy use and cut costs. Programs that automatically turn off unused equipment also contribute to efficient energy use, enhancing your bottom line.

Ensure your business involves employees in energy-saving initiatives. Encourage simple actions like turning off lights when not needed and regulating thermostat settings. An engaged, energy-conscious workforce can significantly reduce unnecessary energy expenses.

Poor Cash Flow Management

Managing cash flow is critical for a thriving business. When you fail to track incoming and outgoing funds effectively, it can lead to financial difficulties. This often results in an inability to cover expenses like payroll, rent, or utility bills.

Late payments from clients exacerbate cash flow issues. Establishing a consistent invoicing process and following up on overdue payments can mitigate this problem. Consider offering incentives for early payments to improve your cash position.

Forecasting cash flow is an essential tool. By predicting revenue fluctuations, you can plan for periods of low income and avoid unnecessary expenses. Adjust your spending based on these forecasts to maintain stability.

Controlling overhead costs is another crucial aspect. Regularly reviewing and cutting back on non-essential expenses can protect your cash flow. This proactive approach allows you to conserve resources for more critical business needs.

Keep an eye on inventory levels. Excess stock ties up cash that could otherwise be used for essential operations. Implementing a just-in-time inventory system can help you maintain optimal stock levels and improve liquidity.

Poor cash management can lead to reliance on credit. While credit facilities offer temporary relief, understanding their high costs and potential risks is important. Regularly review loan agreements and interest rates to ensure they do not adversely affect your financial health.

Taking these steps to improve cash flow management can significantly benefit your business’s finances and ensure its future success.

Employee Turnover Costs

Employee turnover can significantly affect your company’s financial health. As employees leave, the costs related to recruiting, hiring, and training new staff members can quickly add up.

Consider the expenses associated with recruitment: advertisements, hiring agency fees, and time spent by HR professionals to find suitable replacements. A high turnover rate can also lead to an increased workload for existing staff, which can result in overtime pay or a temporary decline in productivity.

Training is another costly factor. New employees often require substantial training to reach optimal productivity levels. This may involve both direct costs, like training materials, and indirect costs, such as the time experienced employees devote to mentoring newcomers.

Employee turnover might also impact morale and team dynamics. The departure of experienced employees can disrupt workflows and reduce team cohesion. This can create an environment where remaining staff might feel overwhelmed or unsettled, potentially leading to further turnover.

Lost knowledge is another consideration. Employees who leave take with them valuable institutional knowledge and expertise, which can be difficult and time-consuming to replace.

Furthermore, customer relations can suffer, particularly if the departing employees were in client-facing roles. Customers often prefer continuity and may feel less valued if they must frequently acquaint themselves with new representatives.

Managing and reducing employee turnover effectively requires investing in employee engagement, competitive compensation, and professional development opportunities. By addressing the root causes of turnover, businesses can reduce these costs and enhance their overall organisational stability.

Hidden Operating Costs

Running a business involves various costs that aren’t immediately obvious. These hidden operating costs can significantly impact your profitability.

One common hidden cost is maintenance. Regular servicing and unexpected repairs of equipment can add up. If you neglect this, your equipment’s lifecycle may shorten, leading to additional expenses in replacements.

Energy consumption also contributes to unseen costs. Monitoring and optimising energy usage can reduce these expenses. Investing in energy-efficient appliances and practices might be beneficial.

Employee-related costs can be overlooked. Training new staff, especially if turnover is high, incurs costs. Additionally, the effects of poor staff morale and productivity can indirectly affect your bottom line.

Don’t ignore administrative expenses. These encompass software subscriptions and office supplies. While they may seem minor, together they can make a noticeable dent in your finances.

Supply chain inefficiencies may inflate costs as well. Delays or mistakes in procurement can lead to increased expenses. Evaluating your supply chain regularly helps identify potential savings.

Another aspect to consider is technology. While necessary, IT infrastructure maintenance, updates, and cybersecurity measures can become costly if not properly managed.

Reviewing these hidden operating costs regularly can help improve profitability. Identifying where these costs arise allows you to make strategic decisions to minimise their impact.

Outdated Technology

Outdated technology can significantly hinder your business operations and profitability. As software and hardware age, they may become less efficient, more prone to errors, and incompatible with the latest applications. This can lead to increased downtime and maintenance costs, directly affecting your bottom line.

Relying on old systems can also pose security risks. Newer technologies often include enhanced security features that protect sensitive data. Without these, your business may be vulnerable to cyber attacks, which can result in financial losses and damage to your reputation.

Another impact of outdated technology is reduced productivity. Modern solutions are designed to streamline workflows and enhance collaboration. When your systems lag behind, employees often spend more time on mundane tasks or troubleshooting issues, which could otherwise be invested in value-adding activities.

Additionally, staying competitive may be difficult if your technology does not support innovations like automation or advanced data analytics. These tools are essential for making informed business decisions and maintaining a competitive edge in today’s fast-paced market.

You may also find it challenging to attract top talent if your technology stack is lacking. Many professionals prefer working in environments where they have access to the latest tools and technologies. Investing in up-to-date technology not only boosts efficiency but also enhances employee satisfaction.

Evaluate your current technology assets and consider whether an update or complete overhaul is needed. Ensuring your business operates on modern, efficient technology can have a substantial positive impact on profitability and growth.

Marketing Strategy Inefficiencies

An ineffective marketing strategy can be a significant drain on your business resources. If you’re pouring money into advertising without seeing a return, it may be time to reassess your approach. Poor audience targeting often results in wasted expenditure and low engagement. Ensure you’re reaching the right people with the right message to maximise results.

Irrelevant or outdated content can contribute to inefficiencies. Regularly updating your marketing materials to reflect current trends and address customer needs will help maintain interest and relevance. Using data analytics allows you to tailor your content more effectively, avoiding generic messages that fail to engage your audience.

Tracking and measuring marketing performance is crucial. Without clear metrics, you won’t know what’s working and what’s not. Use key performance indicators (KPIs) to evaluate success and adjust your strategy accordingly. This will help allocate resources more wisely, ensuring you invest in areas with the highest potential return.

Poorly executed marketing strategies can also lead to costly product delays, particularly when product rollouts rely on awareness campaigns that fail to generate demand on time.

Supplier Negotiations

Effective supplier negotiations can significantly improve your business’s financial health. Start by reviewing your current agreements to identify areas for cost reduction. Examine aspects such as pricing, delivery terms, and payment schedules to see where adjustments can be made.

While engaging with suppliers, always maintain a professional relationship. Demonstrating respect and understanding can lead to better outcomes. Prepare meticulously before negotiations; gather data on market prices, your order volume, and competitor actions to strengthen your position.

Consider negotiating for long-term contracts or bulk discounts if your purchasing volume supports this. Long-term agreements can offer stability and potentially lower prices. Discuss value-added services, too, which may provide extra benefits without additional costs.

Keeping multiple suppliers in your list can enhance your negotiating position. If a primary supplier knows you have alternatives, they are more likely to offer favourable terms. Assess each supplier’s performance continuously to ensure they meet your standards and expectations.

Revisit agreements periodically, as market conditions and your business needs evolve. Regularly revisiting these contracts ensures you remain in a competitive position. Encourage open communication, fostering trust and mutual benefit. Your goal should be a deal that supports both parties’ interests.

Conclusion

Evaluating whether your business is losing money requires attention to detail and strategic planning. By analysing financial statements, maintaining accurate records, and closely monitoring expenses, you can gain a clearer picture of your financial health. Regular review of cash flow and profit margins helps you identify areas for improvement.

Effective budgeting is essential. Creating realistic forecasts and adhering to expense limitations can reduce financial waste. Prioritise cost-effective methods and continuously assess your performance to prevent future losses.

Successful financial management plays a critical role in maintaining business stability. Adopting efficient management practices ensures that your enterprise navigates financial challenges with confidence. Whether you’re managing the business side of wedding photography or running a local trades service, maintaining strong back-office systems can mean the difference between profit and struggle. By being proactive, you can drive your business towards sustained profitability.